How Two Brothers Earn LP Trust As They Scale to $1B AUM | Will Matheson

In this conversation, Will Matheson discusses the operations and philosophy of Matheson Capital, a multifamily investment firm based in Charleston, South Carolina. He highlights their focus on transparency, investor trust, and the importance of communication in building relationships with investors. Matheson shares insights on their investment strategy, fee structure, and the challenges of passive investing, while also addressing how they attract new investors and plan to scale their operations in the future.

Invest Clearly Podcast - Episode 1

Guest: Will Matheson, Matheson Capital

[00:00:34] Pat: Investors and operators, welcome to the Invest Clearly Podcast. I'm your host and CEO of Invest Clearly, Pasquale Zingarella. On today's inaugural episode, I'm talking to Will Matheson of Matheson Capital. We get into how he and his brother built a track record without a big track record, what went wrong on their toughest deal, why they've stayed away from floating rate debt, and his take on sponsors pre-funding distributions. It's honest, sharp, and full of real examples. Let's get into it.

[00:01:16] Pat: Will, thank you very much for joining me. Why don't you start by telling us a little bit about Matheson Capital and how you guys got started?

[00:01:25] Will: Thanks, I appreciate it, Pat. So Matheson Capital—high level—we're based in Charleston, South Carolina, and we invest in multifamily across the Southeast: North Carolina, South Carolina, Georgia, Alabama. That's where we own right now. We started buying in 2018. We've had seven or eight full cycle deals, and I'm very thrilled to say we've never lost any investor capital. That's the short version.

[00:01:49] Pat: That's good. You guys have returned a much higher IRR than I've seen amongst other GPs on Invest Clearly at this stage in your business. What differentiates you in that area?

[00:02:04] Will: I always give this disclaimer whenever people ask about that, which is yes, our average LP IRR is 37.5%. That is bolstered by shorter-term holds. You know how IRR works—very time sensitive. When we were getting started, we were very focused on short-term heavy value-add deals because we bought our first property when we were 25. Shockingly, it's not the tech space—no one's going to give you tens of millions of dollars of equity at that age.

So when we were getting started, we were very conscious that we were going to do heavy value-add deals and get in and out in a short amount of time. On those eight full cycle deals, the average hold period has been pretty short, and that's allowed us to do it.

[00:02:46] Will: But going back to that, we were telling investors, "If you want to do a 10-year hold and get a coupon every three months, then there's someone who's got a lot more gray hair than I do. You can invest with that person. We're not asking you to commit to us for the next 10 years. We don't have a track record. We're 25. I was in high school during the Great Recession. But we want you to date us and see if you like what we do and see if we're competent." That's been a big part of our approach on the exited deals.

There's some other stuff that we do that really differentiates us, which the biggest of all is we're a fixed-rate debt borrower pretty much exclusively. We have one deal with a bridge loan that's floating right there, and that's because we bought it in under 40 days.

[00:03:36] Pat: Very cool. So you didn't have a track record then, you've got a track record now. Everything about Invest Clearly is based around LP trust and creating transparency. Why do your repeat investors trust you currently? And what should new investors know about how you build trust?

[00:03:57] Will: As far as our existing investors and new investors, we try to be as transparent as possible. I say this all the time when I'm doing introductory phone calls—if somebody new wants to be an investor, you're invested in Matheson Capital, you're either going to have my phone number or my brother's phone number. If you ever have questions, you're not getting passed off to some investor relations line, you're not getting passed off to some investor relations email that no one's going to respond to for four weeks or whatever the case may be. If you have a question about your investment, we're going to answer it because I have this antiquated notion that if someone's going to give you tens of thousands, if not hundreds of thousands of dollars, I should pick up the phone when you call. Call me old-fashioned.

So we really try to be as transparent as possible. We're not a monthly reporting group—we used to be, but it's just a huge time drain. But if I send out a quarterly report a month later, I'll have an investor call me. Actually, earlier this week, I had an investor ask me questions about a quarterly report. He asked me on Tuesday. I texted him Wednesday morning saying, "Hey, I saw your email. I'm working on getting you answers, but I'm on the road all day today, so I'm not going to respond. But I saw it and I will address it."

I had a period where I didn't respond to an investor for like four days, and I wrote him an apology email—I'm really sorry, I was on the road again—because I've worked with other sponsors and it's just like a black box. You're just shouting into the void anytime you want an answer. So we try to be incredibly transparent. Obviously the track record matters, we try to be accessible.

We also try to really lay out to people when we show them a pro forma or an investment memo—the parts of it where this is the risk, this is what we think the potential problem is, this is where we don't think that we're actually going to do what the investment memo says. Let me elaborate on that because that's a really weird thing to say.

We're more focused now on longer-term holds than we were when we started. Part of the reason we did the short-term holds back in 2018, 2019, 2020, was so we could do longer-term holds. But it looks really stupid to show a one-year hold on a pro forma—"Yeah, I think I'm going to get you a 40% IRR."

[00:06:22] Will: So we would tell investors, "Yeah, here's a three-year model. We're going to try to sell it in a year, a year and a day for capital gains reasons." We still do that. We're raising on a deal right now. I've had the conversation multiple times where it's an older asset—it'll cash flow. It's a great area. I really like it. The downside is, I don't know what it'll sell for in five years. I have no idea because it's a 1960s construction property. It should cash flow. If we hit our pro forma, we should be able to do some refinancing just on DSCR constraints. But I don't know. And we're very upfront about that.

We're accessible, we're transparent, we lay out the risks, we lay out the upsides. I hope that doesn't sound too boilerplate. Oh, here's one more for you—I'm very transparent about the worst deal we've ever had.

[00:07:17] Pat: Let's hear about it.

[00:07:19] Will: The worst deal we've ever had—Greenwood Village Townhomes. I don't know how many times I've talked about this property. We ended up getting, for a deal that was bought in December of 2019, which you would think, wow, what a great time to buy a deal. We eked out, legitimately like a 1% IRR. I think it's below one. We didn't lose money. Our investors made the most minuscule profit imaginable when we sold it in March of 2022.

There were a lot of reasons it had problems. Right before closing, some bad characters moved into the property. We were scheduled to see them in eviction court the day the courts closed because of COVID. So good timing. And the property, it was small—only 24 units—really gated, serene. But as soon as we couldn't evict the bad characters at the property, the property essentially became overrun. That's a little bit strong in terms, but just drug dealing constantly taking place at the property. All the tenants who actually paid rent left, so Evan and I were pumping money into the property to keep it afloat because we didn't want to go into forbearance, which was all the rage back then.

We were the first ones putting money into the property. We had to go through four different property managers. Some of them quit because the property was such a problem. We ended up getting out of the property in March of 2022 by packaging it with another asset we owned in Charlotte. This was in Charlotte, North Carolina. So we packaged the two together, sold them as a portfolio. We bought it for $3.3 million, we sold it for $4 million, call it. But what ended up happening is we had a yield maintenance prepayment on the loan, so we paid yield maintenance. We had pumped a lot of other money into the deal, so at the end of the day, it pretty much made no money.

But yeah, we were transparent with investors. We've had investors where that was their first deal and they've come back.

[00:09:31] Pat: When you're having that conversation with new investors on the phone that have never met you for the first time, is it received well as "I appreciate the transparency" or is it like, "Oh boy, what's next?"

[00:09:48] Will: I don't know that I've ever really been shut out by an investor. I don't know that that's ever happened, but I feel like most people appreciate the transparency, especially if it's around something like, "Hey, this is a COVID"—this is not really relevant anymore, but this was a COVID-related issue in my humble opinion.

I think where you really run into problems with investors is when you say, "Here is my business plan," and you just fail the business plan. I'm going to buy this property and I'm going to do value-add renovations, and I'm going to hit these rents and this is what's going to happen. And then that doesn't happen.

There are horror stories in South Carolina because South Carolina taxes reassess upon the sale. It's not like a four-year, eight-year cycle. So I've heard stories of someone buys a property, so the taxes go up and then they say they're going to do a value-add plan, and the rents don't go up. So they just made the property less valuable than when they bought it because now the NOI is down because the taxes jumped and they're pumping money into units that is getting no return. That's how I think you really lose investors. But if it's interest rates, if it's COVID, if it's the sales market just swinging out from under you—there are macro factors that we can't control.

[00:11:15] Pat: I think your position, bringing that up on calls, is what LPs are looking for right now. It's refreshing that you say that you and Evan are readily available. I mean, the biggest thing we hear from investors right now, even those that are losing money, are focused on the communication more than anything. It's like, "Yeah, sure. We don't know what's—I'm assuming this is going under, but I just wish someone would call me back." It's a wild thing out there when people are facing total loss of capital. And the one thing they're bringing up more to me than anything is like, "I can't get ahold of them. No one's telling me what's going on." So it's nice.

But that leads me into my next question. So right now it's you and Evan. You are taking the investor calls, you've got direct communication with your investors, you've got big goals over the next few years at a billion under management. How does LP communication and retaining the same trust process and transparency process you have now as you guys scale those acquisitions?

[00:12:17] Will: That is eventually going to become an issue where the amount of conversations with LPs will exceed the amount of time. At some point, I think we will have to hire somebody to do investor relations, which kind of takes away from, "Hey, there's the direct outlet."

But I still maintain, look, if you're investing in our deals, you're going to have my phone number. I think it's a Kevin O'Leary clip where he talks about, "I've got two phones—one's the personal phone, one's the business phone, but you're explaining to people the business one's for emergencies." A lot of people have the number, but a lot of people still don't call it. So it's like, look, if it's a normal IR question of like, "Hey, what's going on? I saw this in the report, what does this look like?" you can go that route. Again, I'm projecting into the future, but I would say, look, you can go the IR route, but if you really need something, you'll still have instant access. You'll have my email and all that stuff because, again, managing equity is a privilege. You're not entitled to doing it.

I think where a lot of sponsors end up getting into trouble is the faucet just becomes so—you turn it and the water pours out and you become a little bit entitled to it. And that leads to when you start juicing the fees to 4% acquisition fees. And I've seen 4% asset management fees before because the money's free and you just take it for granted at that point.

[00:13:54] Pat: Building on that in terms of Matheson, how do you guys make money on your business? How are your fees structured?

[00:14:04] Will: Our acquisition fees are typically going to fall between 1 to 2%, depending on the deal. So it'll be a 1 to 2% acquisition fee, a 2% asset management fee, and that's 2% of EGI. It's not 2% on equity. Some of those fees are really high. I understand it's a little different if you're in a fund structure, but we're typically 2% upfront, 2% on asset management. We used to have disposition fees. I don't think we really incorporate those into deals any longer. So then it's just back-end promotes.

[00:14:44] Pat: Do you guys have any plans to go the fund route or are you sticking with single assets for now?

[00:14:50] Will: Single assets for the foreseeable future. My thing on funds generally speaking is—let me be really direct on that. I think there are benefits to LPs. I think that the fact that if a GP screws up one deal in a fund, they can wipe out their promote. They could do seven good deals, one bad deal, and they'll wipe out the promote. That's good for LPs.

I also think funds allow you—I'm telling you I'm not going to do a fund, I'm talking about all the perks of it—I think funds allow you to compete on timeline as opposed to price and surety of closing because I talk to brokers and I lose deals all the time to discretionary funds because it's just a surety of closing. I've got to tell a broker I have to raise all the money. Fund comes up and said, "I already have it." That's good for LPs. So the GP's portfolio-wide commitment, I think is good for LPs. The fact that you have the money at hand makes it easier to do.

But I don't think I could raise a hundred million dollar equity fund. If you're dealing with a $30 or a $20 million equity fund, you're going to diversify the fund across seven assets, your average check size below $3 million, and then you're just chasing these smaller deals that we're honestly trying to move away from. When we started, we were buying 32-unit deals, 24-unit deals, 15-unit deals. Now we're trying to buy bigger stuff because they're just very demanding on the small end.

[00:16:27] Pat: What do you guys do to attract new investors now? How do you get new investors in the funnel?

[00:16:35] Will: I mean, I'm embarrassed to say you've seen my LinkedIn posts.

[00:16:38] Pat: You're active on social.

[00:16:43] Will: Invest Clearly, I get investors through that website.

[00:16:48] Pat: I wonder because you're super—I mean, socially active, you're literally the only person that ever likes any of my tweets. So I appreciate that, but I didn't know if you guys are one of the ad-running companies or if it's returning investors mainly. You're my only friend on X.

[00:17:16] Will: We're not an ad-running company. I've talked to groups about that and it's like, "Yeah, pay a hundred thousand dollars to set it up." And I'm like, "If you're charging me that, I want guaranteed results." Have you ever heard of Marcus Evans, the company?

[00:17:43] Pat: I have.

[00:17:44] Will: I would love somebody to come out and tell me that they've worked with them as a testimonial to how great they are, but their business model is like, "Pay us a hundred thousand dollars and we will put you in a room with family offices and you can have conversations with them." It's like, I'd rather pay an equity broker. It's a hundred thousand dollar gamble at that point. Maybe they'll work with you, maybe they won't.

[00:18:13] Pat: I know the agencies across—some of the notable ones—but haven't heard of them. That was kind of leading into my sort of—a lot of the GPs are doing it right. They're running ads. They're really heavily investing in influencer marketing.

**[00:18:33] [Ad break for Scale IR]

[00:19:13] Pat: I know you are active on social, which is great. How do you balance what's marketing and what's education? How do you define that? "I'm actually trying to provide value to potential LPs" versus "this is just a get in the funnel now" type process.

[00:19:32] Will: We're not a group that's putting out a ton of educational stuff. There's a few articles on our website that are just explainers on a few things. We send out a monthly newsletter, but we don't do coaching, we don't do educational seminars or anything like that. I am reluctant to really say that the stuff I post on LinkedIn is educational. My LinkedIn theory boils down to: there'll be one thing a day that annoys me and that's what I'll post about.

[00:20:10] Pat: Get after it.

[00:20:12] Will: Something will bother me and I'll just be like, "This is dumb. This is my thought on it." Which is educational in a way, but we don't have a systematic movement. I know some groups have gotten a lot out of that. But I am generally pretty skeptical of a lot of coaching/educational programs because it just seems like—look, I want people to invest with me. Let me be really clear about that. That's the business. But I feel like a lot of things are dressed up as coaching and education when it's really just a feeder to "my deal is going to be good."

[00:20:55] Pat: A lot of that is coming out.

[00:20:58] Will: I mean, if you're—I know some people who do coaching, so this is painting with a broad brush here—but if you're the greatest sponsor in the world, why are you spending all your time coaching? I mean, I could give you a very good reason why: it's the income.

I go on this rant quite frequently. Nobody wants you to make money as a sponsor, which seems like a contradiction, but at least in the front end, because you have to invest, call it 10%, and then you get the fee. And some groups are like, "Well, 10% net of fee." So you're putting in your acquisition fee into the deal because it's 10% plus whatever your acquisition fee is—money's fungible. But the whole point is you're not making money when you buy the deal. And the asset management fee is not huge. And you're going to have an asset manager, so you really only make money when you sell a deal, which makes sense in some respects. It's just—I think people coach because of the income. We don't do either one of those. We had a lot of successes. We're in a really good situation financially. But we still try to stagger deals so that we believe we're going to have an exit every year or something like that. We still do that.

[00:22:18] Pat: Now to the question we were talking about beforehand: what part of passive investing do you think needs to die?

[00:22:31] Will: A part of passive investing that I really think needs to die is funding your distributions upfront through investor equity. It's not even robbing Peter to pay Paul, it's just robbing Paul to pay Paul. It's not a real return, it's a synthetic return. You're just collecting someone's money to then give it back to them because your asset is not cash flowing.

The other aspect of it, which I think a lot of investors miss, is that you're just making it harder to end up profiting at the end of the day when you do that because now you're getting a preferred return on top of the money that's being returned to you for your original preferred return.

You'll see deals where someone might be buying it for, say, a hundred thousand per unit, but between their reserves, which are really used to pay the investor, and the closing costs and the rate buydowns and the CapEx and the fees, there'll be $150,000 basis on a $100,000 purchase. And it's like, well that's great, but now the value of the asset has to go up by 50% just for you to break even. To get your equity out, you have to increase the value of the asset by over 50%, which maybe that works, but I feel like people overlook that. They see the basis of the asset, but they don't see the total capitalized basis. And I think pre-funding your returns is a big part of why that happens.

[00:24:05] Pat: There was a good stretch where it was literally a theme on LinkedIn or X where people were just shredding those decks. They were coming in droves and people were just slaughtering them online. It was an interesting thing to see being a trend.

[00:24:25] Will: And it kind of should be. I mean, if you're doing a rate buydown on a Fannie or a Freddie loan, that's kind of—there's a limit to what you can do. If you're taking out a bridge loan and buying it down to 5%. I mean, the fees on that can be astronomical, but it's like, "Oh yeah, look, I have this 5% rate that I paid $5 million for upfront, and now I can quote-unquote show cash flow." I mean, that's another way of essentially pre-funding your deals. There's a limit to what you can do with Fannie and Freddie. So I'll kind of give that a pass. But with the bridge lenders and buying it down to 5% cap rates, that's essentially pre-funding your distributions by artificially compressing your debt service.

[00:25:21] Pat: I know we're coming towards the end here, so I'd love to know—are you guys raising right now? Is there anything additional you guys want to talk about in terms of Matheson or your deals or anything that we haven't gotten to?

[00:25:35] Will: I mean, we are raising, but we're bringing that to a close. We try to stay active, but you know what, I really—and you didn't tell me to do this—I'm being pretty honest with you, so just a peek behind the curtain is we met Spring 2024.

[00:25:52] Pat: Yeah, it was.

[00:25:56] Will: Yeah. So we met at BiggerPockets Best Ever in 2024. And I was like, "Wow, this is a great platform." Every time we have a closing, we're like, "Here, investors, look over here. Go to Invest Clearly." So as your inaugural podcast, I think this is your inaugural—can you talk about the platform, which again, you didn't ask me to do, but I love the platform. I think it's great. I think there are a lot of bad GPs out there. I think some GPs broadly kind of get a bad rap, but I think there are bad GPs and I think Invest Clearly is a great way to highlight good ones and weed out bad ones in a verified way. So please talk about that.

[00:26:41] Pat: I'll actually turn it back on you a little bit because I appreciate that and you were one of our really early adopters, and I know that platforms at the early stage are not easy to have confidence in. But I would actually love to learn—if you like, what led you to actually start leveraging Invest Clearly? Obviously there are the surface level items, but if you even take the business out of it, why did you kind of take the jump to ask your investors to start putting things on there?

[00:27:18] Will: So it really is two things. Number one, I'm incredibly full of myself, so I couldn't imagine anybody giving us a bad review. At the time I started, we had a 40% average LP IRR, and as I posted about on LinkedIn, we had a great deal that we bought in October 2023, we sold in December 2024, so it's a great deal. It's a 40% return to the investor, but because it was in 14 months and not 12, it dropped our IRR to 37.5%.

[00:27:49] Pat: Heartbreaking.

[00:27:51] Will: Heartbreaking stuff. I posted the tombstone of our 40% IRR out there. The big thing was I was really confident in us. I was really confident in us, so I thought we would get really great reviews. And on the other end, I knew there were going to be other investors or other sponsors who felt the same way. Other investors out there and people who are reviewing other sponsors would see what we're doing and they'd be like, "Oh, I'm curious. Let me see who Matheson Capital is," et cetera.

And we've had people come to us who said, "Look, I heard about you on Invest Clearly." And the thing about that is, I know some people kind of take this approach of, "Oh, well I don't want my investors to be looking up other sponsors." Well, you don't own an investor. That doesn't mean you're going to go around and introduce every sponsor to, "Hey, here's John. He's invested with me seven times." You're not going to do anything like that. But they're all adults. They're going to look for their own deals. If they want to look for new sponsors, they're going to look for new sponsors because they know what your job description is.

Real estate, private equity, real estate syndicator—go on LinkedIn, just Google it. So we felt like, look, if our investors are going to look for other sponsors, great, they'll be diversified. They'll work with other people, they'll see why we're the best. So we weren't worried about our investors seeing other sponsors, we also saw the upside. And look, if we're active on this site, other investors from other sponsors will see what we do and they'll like that. And it's just a math game, which again, I think is a huge value to what the website is. Because there's a hundred other sponsors—well, actually, you might know how many sponsors are on your website.

[00:29:45] Pat: We're flirting with 1,400 now. A little over a hundred that are actively engaged. You guys are one of the most engaged sponsors on there. But right around a hundred actively leveraging it.

[00:30:05] Will: So there's a hundred sponsors that are actively leveraging it, but you've got 1,400 sponsors, so I'm sure there are a bunch of people out there who have invested in—I'm not going to name a sponsor who's fallen on unfortunate times. That just seems mean, the ones that are publicly known—but their investors are coming out and they may see us even if the sponsor's not actively engaged. So if there's 1,400 sponsors in the world and we're doing a good job, that's—there are plenty of groups bigger than us. They'll see us. I stand more to gain by being active on your site than I stand to lose. I'm not losing anything because I don't own an investor.

[00:30:52] Pat: What's interesting about that too is that is a fear of some, right? And we exist whether or not the GP participates anyways. But my partner Joe runs another company called Scale IR, and they put together a data set across their client base of how many LPs were actually in multiple GP databases, and I think it was some odd 40% of the LPs that enter into a GP's database as an interested person was actually in at least one or two other GP databases and it happened within the first 30 days. So I think the ignorance that your LPs aren't shopping is kind of a wild concept. It's like people are shopping across the board and it's better to represent yourself in the best light possible for when they see it than to just kind of bury your head in the sand and think they're only looking at me.

And I appreciate everything you said. And look, I've been kind of conservative on other podcasts that I've gone on, but everything you listed is sort of the reason why we did start this. When I was selling accredited investor lead gen services at one point, I had talked to a sponsor who their coaching program was killing it and their real estate was getting beat up. And it was just a wild thought to me. And at the same time, there were really great sponsors out there that aren't marketing are going unheard of that really didn't have a place to be found. And that was our goal. Let's work with these companies who have deep relationships with their LPs that keep returning, that may not be spending tens of thousands of dollars a month in ad spend, and let's give them a way to be represented and neutralize the marketing spend of other people who may or may not be good sponsors, but just have deep pockets.

So I appreciate everything you said and I really appreciate the support you've shown us. And even something as simple as this, you're the one that told me to start this podcast. So it's something we've been thinking about for a while, but your nudge was like, "All right, I'll finally do it."

[00:33:07] Will: Well, don't give me too much credit because as we discussed at the beginning, part of the reason I encourage you to do the podcast is if a GP is anything like me, they just love to talk into a microphone and hopefully no one leaves us a bad review. But if they do, I'm sure we would deserve it.

[00:33:26] Pat: It's a good way to think about it.

[00:33:28] Will: I was—so that was just one of the other notes just in terms of the reason why you started and all that stuff, which is you verify that the investors are real. You verify that an investor is real. You don't need the GP to approve of the person. It's like, "Hey, do you have a K-1? Do you have a screenshot from inside your portal?" or something like that. So it's not Yelp. There is an anonymity aspect of it, which some investors like, some investors don't, but there's an anonymity to it, which I think investors can appreciate, especially if it's a bad review. But it's verified.

Yeah. Instead of—it's kind of like, yeah, did the results actually matter? Are the investors happy? If the investors are happy and they're real investors, then they're going to come forward and they're going to talk about it.

So I think it's a great service and I'm glad you're starting this. And I hope a lot of GPs come on. Even the ones that have—obviously the ones that are doing well, I hope they come on and I hope the GPs that have kind of fallen on a bit of a hard time with floating rate debt. I'll give this as a fixed-rate borrower. I don't hold this over people's heads. I have some real sympathy, like, look, 2020, 2021, I think some pricing got really stupid, but it wasn't until December of 2021 when the Fed actually started saying, "Oh yeah, we're going to start raising rates." It all changed in October to December. And then, they just kept saying, "We're keeping them low, we're keeping them low, we're keeping them low. Inflation's transitory." And people bet that that was accurate and that has caused a lot of problems for people. So I do have a lot of sympathy even though we stayed immune to that pressure. We never got into the floating rate bridge loans. We always stayed with fixed-rate debt. So I'm sympathetic, but I hope a lot of those GPs come on as well because there was a little bit of group think there.

[00:35:33] Pat: I hope so too. Well, thank you so much for joining me. Thanks for nudging me to do this and look forward to keep working with you.

[00:35:39] Will: Yeah. Thank you Pat.

[00:35:42] Pat: Thanks for listening to the Invest Clearly Podcast. To find verified investor reviews or to claim your GP profile, please visit investclearly.com. If you enjoyed this episode, please remember to like, subscribe, and leave a review because that's how other people find this show. Till next time, invest clearly.

Written by

Invest ClearlyInvest Clearly empowers you to make informed decisions by hosting unbiased reviews of passive investment sponsors from verified experienced investors.

Other Articles

Passive Real Estate Investing Advice from Experienced LP Investors

Experienced LPs shared their most valuable lessons, drawn from years of investing across various asset classes and sponsor relationships.

LPs Have Been Slacking on Due Diligence—Here’s How to Step Up Your Game This Year.

Market volatility, rising interest rates, and unexpected shifts in asset performance have underscored the importance of thorough due diligence. For Limited Partners (LPs), the need to sharpen their evaluation strategies has never been greater. Whether assessing a new sponsor, evaluating a deal, or stress-testing an underwriting model, a refined due diligence approach can help mitigate risk and enhance returns.

What Is a Capital Stack?

Every real estate deal needs funding, which is why real estate syndication and private equity investments have become so widespread. However, where that money comes from and in what order it gets repaid isn't random. It's structured carefully, layer by layer, in what's known as the capital stack.

Power of Community in Passive Investing | Brian Davis

Brian Davis shares how Spark Rental's co-investing club vets deals, evaluates operators, and helps investors build passive income

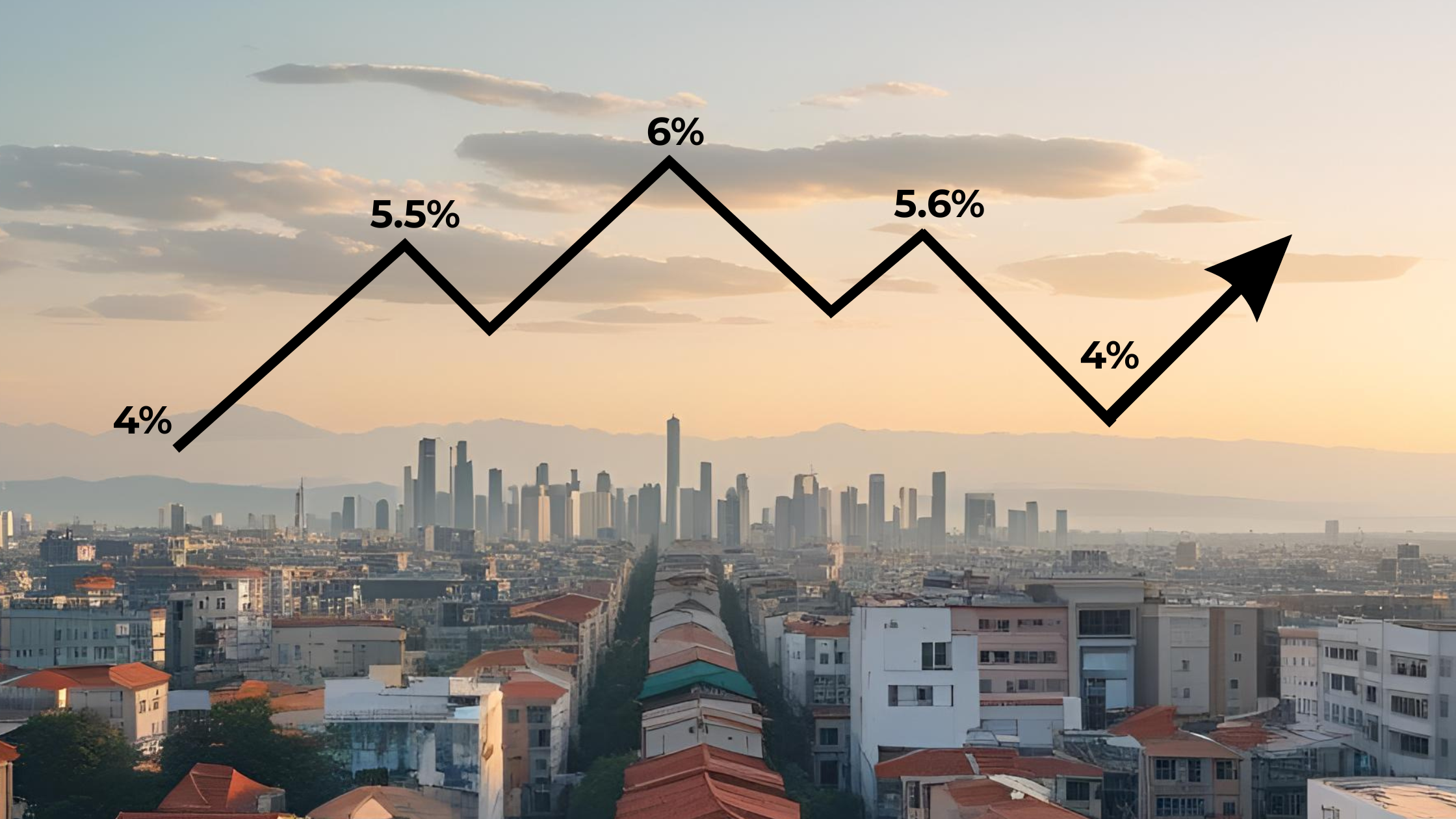

What is a Capitalization Rate in Real Estate

Learn about cap rates, how they are used in commercial real estate, and how investors should consider them when evaluating passive real estate investments.

Evaluating Real Estate Sponsors: The Role of Social Proof in Investment Decisions

This article explores the role of social proof in evaluating real estate sponsors, the risks of relying solely on past returns, and the dangers of influencer marketing in investment decision-making.